Grayscale, one of the issuers of the impending Ethereum exchange-traded funds (ETFs), has lowered the management fee for its Mini Trust to 0.15% from 0.25%, according to a July 18 filing.

The firm stated:

“Grayscale Investments has updated its registration statement for Grayscale Ethereum Mini Trust to reflect a management fee of 0.15%. Additionally, we are waiving the fee to 0% for the first six months, applicable up to a maximum of $2 billion in assets under management (AUM).”

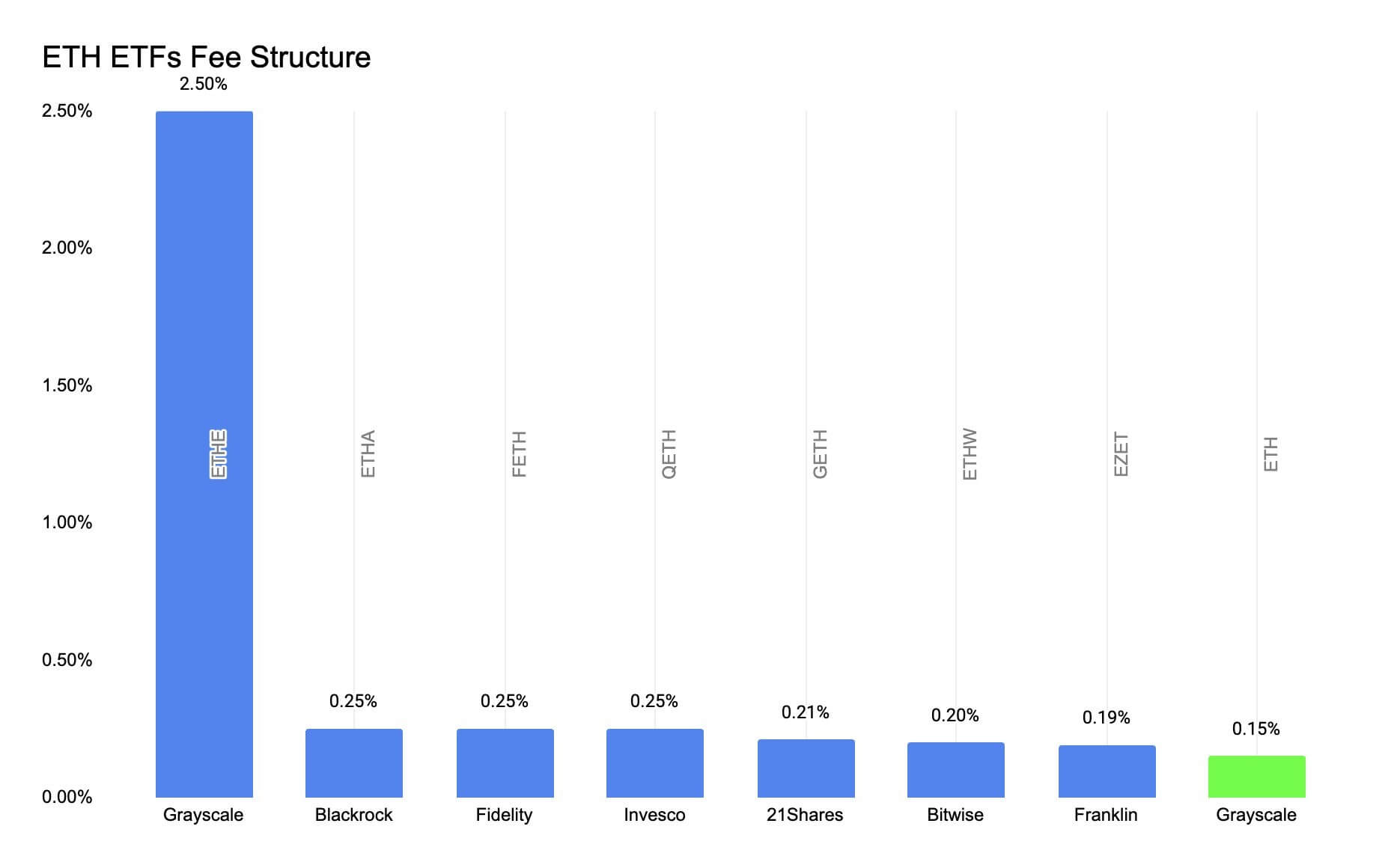

This move positions Grayscale’s Ethereum ETFs as both the cheapest and most expensive. The Grayscale Ethereum Trust (ETHE), which will convert to an ETF, maintains a 2.5% fee structure, while the Mini Trust would attract the cheapest fee in the market.

Market analysts previously predicted that ETHE’s high fees might drive investors to cheaper alternatives from rivals like BlackRock, Fidelity Investments, VanEck, Bitwise, and Franklin Templeton, with fees between 0.19% and 0.25%.

Notably, a similar situation occurred with spot Bitcoin ETFs. Grayscale’s Bitcoin Trust has experienced over $18 billion in outflows since its conversion to an ETF in January, with investors piling into cheaper ETFs from BlackRock and others.

To prevent a repeat, Grayscale is seeding its Mini Trust by reallocating 10% of the $10 billion from ETHE. And by lowering the Mini Trust fees, Grayscale offers the most competitive rates.

Market observers believe this move would tame some of the likely ETHE outflows. Crypto analyst Karl said:

“Grayscale lowered ETH fees to 0.15%. It is now the most competitive ETF from a fee-perspective, this will likely avoid [assets under management] leakage from Grayscale and reduce ETHE outflows. There are rumors the ETHE -> ETH conversion is tax-exempt, which would be even more bullish.”

Similarly, Nate Geraci, president of ETF Store, highlighted the significance of this move, stating it was a bold strategy given Grayscale’s pivotal role in launching crypto ETFs.

He added:

“Grayscale paved regulatory path for spot btc & eth ETFs. Period. No reason not to capitalize on that by taking leadership position in how they approach competition in spot crypto ETF category.”

Mentioned in this article

Credit: Source link